2018 Tax Changes – Some things You Need to Know!

I bet on June 29th, 2018 when the new tax changes were released, you had your eyes glued to the computer, ready to read up on the latest changes! I know – No way. Well that’s cool.

There were more changes than you think, here are some….

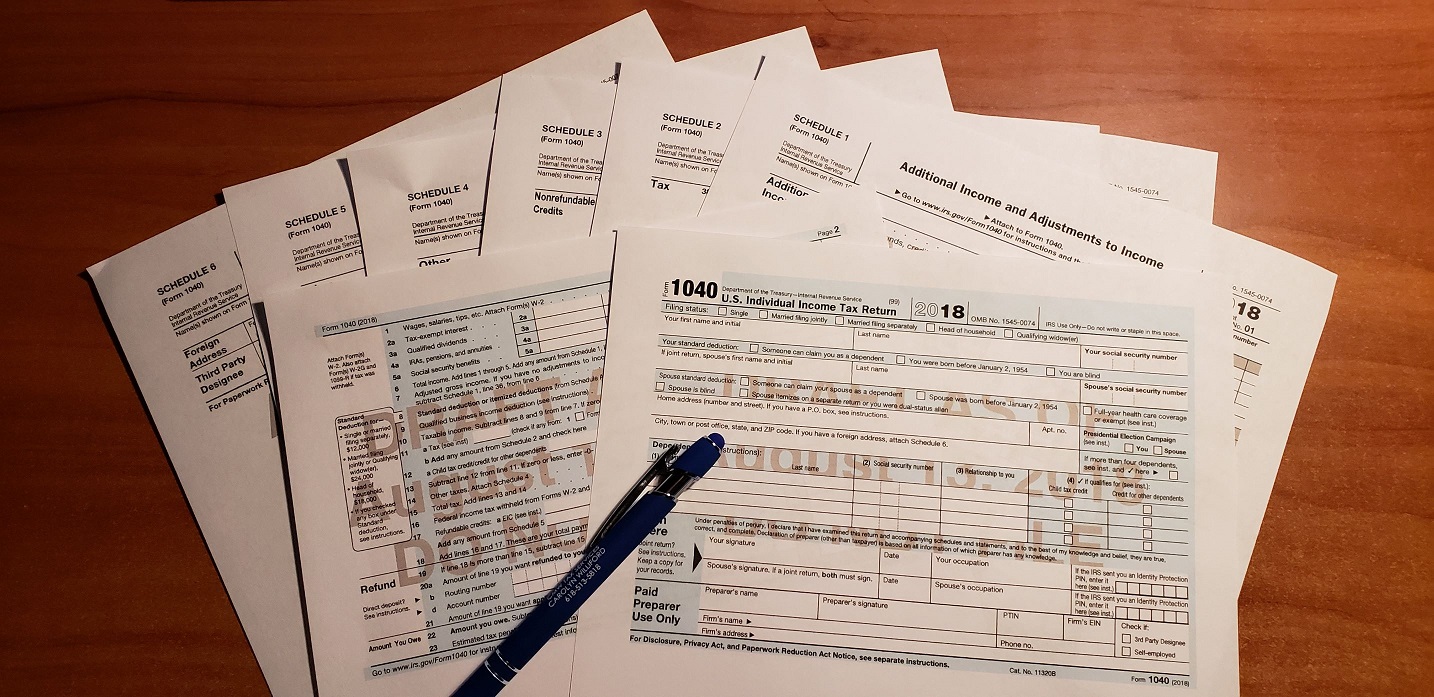

The IRS released a draft of its new form 1040 that all American taxpayers will use to file their 2018 tax returns. The anticipated form is significantly different than in 2017.

It will take the place of the 1040-A, 1040-EZ, now all 1040 filers will use one form. And yes, the form seems smaller, but it is a mirage…

Here are somethings you should know about the new form:

They said it would be the size of a postcard..

President Trump said he would simplify the tax code and create a new form that people could fill out themselves, postcard sized returns. Yes, the new 1040 for is basically the size of a post card, but what they forgot to mention, was they would just move items off to include six additional schedules. The new postcard-sized document is just 23 lines, down from 79 on the current form. You can view the IRS’s draft Copy on the agency’s website for yourself.

On to the additional schedules:

For American’s with simple returns who may have filed the 1040-ez, the new return will be easy to use. For those with more complicated tax situations, are going to have more work.

In addition to the Schedule C and A already used, you will have additional schedules to worry about.

- Schedule 1 is for taxpayers with additional sources of income like schedule C income/loss, Capital Gain/loss, Farm gain/loss or adjustments to income, such as IRA contributions, student loan interest, Self-employed retirement plans, and health savings account contributions.

- Schedule 2 is a form for people with some other forms of taxes, such as Alternative minimum tax, excess advance of premium tax credit..

- Schedule 3 is for nonrefundable tax credits, such as child and dependent care expenses, Education Credits, Retirement savings credit.

- Schedule 4 is where taxpayers will add up certain taxes, such as self-employment tax, uncollected Social Security and Medicare taxes, and others.

- Schedule 5 is to add up tax payments, such as estimated tax payments or amounts paid with an extension.

- Schedule 6 is where you can appoint a third-party designee to discuss your tax return with the IRS on your behalf.

Here are some of the changes for 2018

New Tax Brackets

Tax Rate Single Married/Joint& Widow(er) Married/Separate Head of Household

10% $1 to $9,525 $1 to $19,050 $1 to $9,525 $1 to $13,600

12% $9,526 to $38,700 $19,051 to $77,400 $9,526 to $38,700 $13,601 to 1,800

22% $38,701 to $82,500 $77,401 to $165,000 $38,701 to $82,500 $51,801 to $82,500

24% $82,501 to $157,500 $165,001 to $315,000 $82,501 to $157,500 $82,501 to 157,500

32% $157,501 to $200,000 $315,001 to $400,000 $157,501 to $200,000 $157,500 to $200,000

35% $200,001 to $500,000 $400,001 to $600,000 $200,001 to $300,000 $200,001 to $500,000

37% over $500,000 over $600,000 over $300,000 over $500,000

The personal exemption of $4,050 was eliminated – This was a big loss for taxpayers with kids.

2018 Standard Tax Deduction Table for 2018 Return Filed in 2019

Filing Status Standard Deduction

Single $12,000

Head of Household $18,000

Married Filing Separately $12,000

Married Filing Jointly $24,000

Qualifying Widow(er) $24,000

For 2018, the additional standard deduction amount for the aged or the blind is $1,300. The additional standard deduction amount increases to $1,600 for unmarried taxpayers.

The Child Tax Credit has been increased. If you qualify, the credit can be worth up to $2,000 per child for Tax Year 2018-2025.

Does SALT (State and Local Tax) Apply To Me?

Since the standard deduction for your 2018 return almost doubles due to tax reform, (from $6,350 to $12,000 for single filers, $12,700 to $24,000 for married filing jointly and widow filers, and $9,350 to $18,000 for Heads of Household), it will not be beneficial for most taxpayers to itemize on their returns and the changes to the SALT deduction won’t affect them.

For Tax Year 2018, the EITC (Earned Income Tax Credit) is not available for taxpayers with an adjusted gross income over:

$15,270 with no Qualifying Children ($20,950 if married filing jointly)

$40,320 with one Qualifying Child ($46,010 if married filing jointly)

$45,802 with two Qualifying Children ($51,492 if married filing jointly)

$49,194 with three or more Qualifying Children ($54,884 if married filing jointly)

All miscellaneous deductions subject to 2% of your AGI are eliminated for Tax Years 2018-2025.

- Unreimbursed work expenses (tools, home office, supplies, uniform, job search)

- Qualified employee education expense

- Tax preparation services

- Professional Dues

- Moving expenses (except military personnel)

- Casualty loss (except national disasters designated by the President)

- Alimony Deduction

- And more….

The shared individual responsibility payment remains in place. Taxpayers that don’t maintain health insurance coverage must claim a waiver or exemption or be subject to the penalty. For 2018, the penalty is equal to 2.5% of your AGI, or $695 per adult and $347.50 per child, up to a maximum of $2,085, whichever is higher. That amount is unchanged from 2017. But will be repealed for 2019 thru 2026.

Estate tax

The estate exemption doubles to $11.2 million per individual and $22.4 million per couple in 2018.

Contribution limits for retirement savings

Employees who participate in certain retirement plans ‒ 401(k), 403(b) and most 457 plans, and the Thrift Savings Plan – can now contribute as much as $18,500 this year, a $500 increase from the $18,000 limit for 2017.

Stay tuned for more updates….

Carolyn